Intro

Figure: Conceptual graphic of Pi Network in news media. Pi Network, a mobile-centric blockchain with over 50 million users, is gearing up for an ISO 20022 upgrade scheduled for November 22, 2025coindcx.comcoinpedia.org. ISO 20022 is the international messaging standard that banks worldwide are adopting for cross-border paymentscoindcx.comswift.com. By aligning with this protocol, Pi Network aims to “improve integration with banking systems” and expand its payment ecosystemcoindcx.comcoinpedia.org. In plain terms, ISO 20022 allows financial institutions (banks, fintechs, payment networks) to “communicate in a unified digital language” with richer, structured datacoindcx.comswift.com. Major banks and SWIFT (the global interbank Pi Network) mandate ISO 20022 by late 2025swift.comccn.com. This means any cryptocurrency that can speak the same “data language” as banks may gain easier access to traditional finance and faster international transactionscoindcx.comccn.com.

ISO 20022 replaces older formats like SWIFT’s MT messages with XML, enabling “faster, more secure, and structured cross-border payments”coindcx.comcoindcx.com. For crypto projects, compliance can be a bridge to the legacy systemccn.comccn.com. For example, CoinDCX notes that by adopting ISO 20022 Pi Network could “reduce errors, increase transparency, [and] speed up international transactions”coindcx.com. SWIFT itself emphasizes that ISO 20022 is a “common global standard for cross-border transactions” and is vital for faster, more efficient paymentsswift.comccn.com. In practice, this means a Pi transaction could carry the same standardized metadata (payment purpose, remittance details, account IDs, etc.) as a bank wire, making Pi transfers natively interpretable by financial systemsccn.com.

ISO 20022 and Cross-Border Finance

ISO 20022 is being embraced globally as part of a massive SWIFT migration. By November 22, 2025, SWIFT will operate fully on ISO 20022, ending the “MT/ISO coexistence” periodswift.comccn.com. After that date, payments in the old MT format will require translation, or risk poor interoperabilityswift.comccn.com. The standard offers richer, more granular data in every payment messageswift.comcoindcx.com. This boosts compliance and reduces errors, as financial institutions can include full information for regulators, auditors, and endpointsccn.comcoindcx.com.

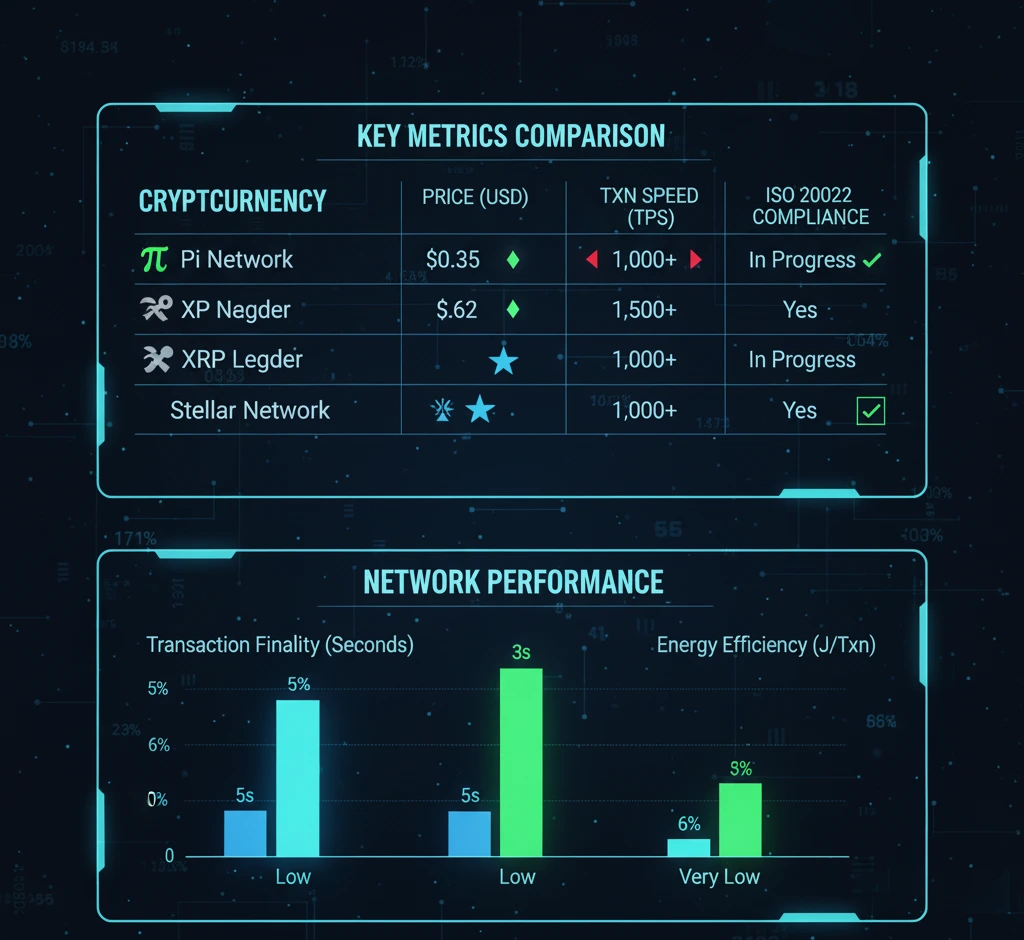

Several cryptocurrencies are already ISO 20022–compliant or aligned. XRP (Ripple) and Stellar (XLM) are prime examplestangem.combitget.com. Both have participated in ISO 20022 working groups and support structured messaging formatstangem.combitget.com. Other Pi Network(Algorand, XDC, Hedera, etc.) also aim for compliancetangem.com. In practical terms, ISO 20022 compliance means these coins can more easily interface with bank systems. For instance, Ripple’s enterprise payment solution (RippleNet) already uses ISO-compliant messages to help banks send standardized transaction data with “faster, traceable, and low-cost” settlementstangem.comccn.com. Similarly, Stellar’s network is built for fast, low-cost international payments and financial inclusiontangem.combitget.com. In fact, Stellar Foundation is also part of the ISO 20022 standards bodyccn.comtangem.com, reflecting its alignment with these goals.

Pi Network’s ISO 20022 Upgrade

Pi Network announced it is officially joining the ISO 20022 standards group alongside Ripple and Stellarcoinpedia.org. The CoinPedia report confirms “Pi Network has reportedly joined the ISO 20022 standard group… alongside industry leaders such as Ripple (XRP) and Stellar (XLM)”coinpedia.org. This formally connects Pi to the same global messaging protocol used by banks to exchange transaction data. Per CoinPedia, this move “connects Pi to the global financial messaging system used by banks to exchange transaction data”coinpedia.org. By doing so, Pi Network can leverage the standardized structure to improve transaction accuracy, reconciliation speed, and regulatory compliancecoinpedia.orgccn.com.

Figure: Public talk at a Pi Network event, highlighting the community-driven approach. Pi’s team, founded by Stanford graduates, is building its network to meet ISO 20022 specs. CCN notes Pi is progressing through a three-phase integration roadmapccn.combitget.com. Phase 1 (now through 2025) focuses on Preparation – upgrading Pi’s architecture, implementing compliance APIs, and developing a decentralized exchange (DEX)ccn.com. Phase 2 (Activation) coincides with SWIFT’s migration: when banks switch to ISO 20022, Pi will “generate and interpret messages in the same format”ccn.com. Phase 3 (Adoption) involves demonstrating real-world usage – for example processing actual remittances and merchant payments via ISO channelsccn.comcoinpedia.org. In short, Pi is designing its Pi Network from the ground up to natively support ISO 20022.

CoinPedia further details that Pi plans “full alignment by November 22, 2025, rolling out upgrades in stages”coinpedia.org. The stages – Preparation (tech upgrade), Activation (syncing with banks), Adoption (new use cases) – mirror exactly what CCN describescoinpedia.orgccn.com. This alignment is timely: if achieved, Pi transactions would carry ISO 20022 tags from day one, allowing banks to process them without extra translationccn.com. Pi is also building compliance infrastructure. CCN reports Pi is creating a Pi DEX and KYC/AML tools so institutions can handle Pi payments legallyccn.com. The mainnet opened publicly in early 2025, enabling external wallets and partner integrations under compliance rulesccn.com. In effect, Pi’s Open Mainnet and ISO readiness aim to make the network “operate more like a recognized global payment system”ccn.com. In the words of Pi’s community lead, nodes are being set up to bridge Web3 infrastructure with global financeccn.com.

The rationale is clear: by embracing ISO 20022, Pi hopes to interface smoothly with banks and expand use cases. Bitget News notes that this upgrade “aims to facilitate smoother integration with conventional banking systems, improving both the efficiency of international transactions and adherence to regulatory standards”bitget.com. In effect, Pi Network could become a digital rail that ties its huge mobile user base into the financial mainstreamcoinpedia.orgbitget.com. CoinPedia and Bitget emphasize that smoother, faster transfers and better compliance are the promised benefitscoinpedia.orgbitget.com. Pi’s large community (50M+ on mobilecoinpedia.orgccn.com) could allow it to capture volume if it converts that base into real payments.

XRP Ledger: Legacy in Cross-Border Payments

The XRP Ledger (run by Ripple) is already deeply engaged with ISO 20022 and cross-border finance. Ripple has long marketed XRP and RippleNet as bank-friendly payment rails. As Tangem explains, Ripple’s network “aims to simplify global financial transactions” and acts as a bridge currency to cheaply exchange value between different fiat currenciestangem.com. Ripple’s enterprise product, RippleNet, uses ISO 20022–compliant messaging to connect banks and payment providerstangem.comccn.com. In late 2024, Ripple even joined the ISO 20022 Standards Body, giving it a seat in shaping the standard’s futuretangem.com.

In practice, banks using RippleNet benefit from “faster, traceable, and low-cost transactions”ccn.com, and XRP serves as on-demand liquidity to settle transfers quickly. XRP itself isn’t formally “ISO-certified,” but Ripple’s infrastructure fully supports the standardccn.com. By aligning early, Ripple has shown what an established player can achieve: deep banking partnerships, regulatory compliance tracks, and persistent real-world volume. Indeed, CCN notes Ripple’s example sets a high bar – Pi Network will need “similar institutional credibility and reliable infrastructure” to match Ripple’s impactccn.com.

Nevertheless, Ripple’s rail has faced criticism (e.g. for centralization or litigation), which industry leaders like SWIFT warn about. SWIFT’s CIO has publicly said banks distrust rails controlled by a single company, emphasizing that “trust, governance, [and] legal enforceability” matter more than speed aloneccn.com. Even if technically compliant, a network must appear neutral to gain broad adoption. CCN’s analysis highlights this point: Pi Network claims decentralization, but “full governance transparency and institutional oversight are not yet fully documented”ccn.com, in contrast to Ripple’s more corporate-controlled model.

Stellar Network: Focus on Inclusion

Stellar was created explicitly for cross-border value transfer, with an eye on the unbanked. Stellar’s consensus protocol (SCP) enables fast, low-cost payments through trusted nodestangem.com. The network uses its native token (XLM) as a bridge asset between currencies, similar to how XRP is usedtangem.com. Stellar’s decentralized exchange (built into its protocol) and support for tokenized assets means it’s often used for remittances and micro-payments.

Tangem notes Stellar “enables fast, low-cost cross-border transactions and promotes financial inclusion”tangem.com. It even links traditional players: for instance, Stellar supported MoneyGram’s USDC on/off ramp, demonstrating real-world remittance use casesccn.com. Stellar is also a member of the ISO 20022 standard body, reflecting its “mission [that] mirrors ISO 20022’s goals of inclusivity and transparency”ccn.com.

In short, Stellar’s strengths are wide reach in emerging markets, low fees, and open rails. It is battle-tested on public networks for years (unlike Pi Network , which only opened its mainnet in 2025)ccn.com. CCN points out that Pi’s aspiration overlaps with Stellar’s mission, but Stellar has had a head-start in running compliant, open networks. If Pi can complete its ISO integration, it might emulate Stellar’s model: seamlessly moving value between fiat and crypto with full compliance metadataccn.com.

Pi vs. XRP and Stellar: A Comparative Analysis

Compared to these established ISO-ready networks, Pi Network has unique features and challenges. On the plus side, Pi’s user base and accessibility are unmatched: it boasts a mobile-first design and tens of millions of app downloadscoindcx.comcoinpedia.org. CoinDCX highlights that Pi “differentiates itself with a mobile-first approach and over 50 million app downloads”coindcx.com, which could translate into vast reach once the chain is live. Bitget and CoinPedia also note Pi’s large community, implying Pi could be “one of the few community-driven digital assets” ready to interact with banksccn.combitget.com.

However, Pi still lags in maturity. Unlike Ripple and Stellar, Pi has only recently moved from a closed testnet to an open network. As a result, it currently lacks the critical foundations those networks have built over years. For example, Pi today has few institutional partnerships, limited liquidity, and no proven track record of real-world volumecoindcx.com. CoinDCX bluntly notes Pi “lacks institutional partnerships, liquidity, [and] the proven track record of XRP Ledger and Stellar”coindcx.com. Pi’s token also isn’t listed on major exchanges yet, so there’s no official price or market data – factors that CCN warns raise skepticismccn.com.

In technology and compliance, Pi is still catching up. Ripple and Stellar have fully built-out ISO messaging (RippleNet and Stellar’s SEP-9/SEP-31 proposals)ccn.comweb3enabler.com, and banks and regulators know their codebases. Pi’s ISO 20022 claims, so far, are largely on roadmap rather than proven in productionccn.com. CCN cautions that Pi’s plan remains “aspirational rather than proven” until it can show real ISO payments and undergo independent auditsccn.com. Governance and trust are also open questions: banks favor networks with transparent, shared governance and broad oversightccn.comccn.com. Pi is decentralized in theory, but institutions will want clear evidence of neutrality and compliance infrastructure.

Opportunities and Challenges for Pi Network

Despite these challenges, Pi’s ISO 20022 upgrade does open concrete opportunities. If executed well, it could unlock new use cases and markets. For example, CoinDCX and CCN enumerate potential growth areas: enhanced wallets, merchant payments, and remittancescoindcx.comcoindcx.com. After ISO adoption, Pi could serve as a bridge for international remittances from Pi-holders, or as a platform for crypto-fiat merchant settlements. CCN even suggests future scenarios like government-sanctioned Pi remittance channels, institutional custody solutions, and regulated banking apps that natively use Piccn.com. In essence, Pi could target niches – especially in developing markets – where traditional banking is weak.

Some of the key opportunities include:

- Inclusive remittances: Pi Network could enable low-cost money transfers for the unbanked, similar to Stellar’s use casescoindcx.com.

- Mobile merchant payments: With ISO 20022 compliance, merchants (even in remote regions) could theoretically accept Pi using standard banking rails.

- Institutional partnerships: Aligning with the ISO standard might make banks and fintechs more willing to pilot Pi, particularly as they switch over in 2025bitget.comcoinpedia.org.

- Decentralized finance on Pi: The planned Pi DEX and compliance tools could attract DeFi projects that need to interact with fiat systems.

- AI & Web3 applications: Pi’s recent partnership with OpenMind AGI (a decentralized robotics/AI OS) shows it’s expanding beyond paymentscoindcx.combitget.com. Leveraging its node network for AI tasks (350,000+ active nodesbitget.com) could give Pi extra utility and revenue streams.

At the same time, significant hurdles remain:

- Regulatory compliance: Beyond messaging standards, Pi must satisfy KYC/AML and other financial regulations. Its team is building tools for that, but adoption by banks requires audits and licensesccn.comccn.com.

- Liquidity and ecosystem: Pi needs real token liquidity and use-cases. Without tradable Pi coins, banks have less incentive to engage. Community enthusiasm must translate into actual transactions.

- Institutional trust: As noted, Pi Network must prove neutrality and governance maturity. Pi will have to convince regulators and partners that it is transparent and resilient.

- Mainnet performance: Technologically, Pi must demonstrate it can handle payment volumes, which is untested at scale. Reliability and uptime will be crucial.

- Competition: Other ISO-aligned networks (XRP, Stellar, Hedera, XDC, etc.) are also chasing cross-border finance. Pi must carve out its niche against these incumbents.

In summary, Pi’s ISO 20022 upgrade is a necessary first step for cross-border ambitions, but not a guarantee of success. As CoinDCX concludes, Pi has “potential to reshape inclusive digital finance”coindcx.com thanks to its user base and focus, but “its success will depend on turning this potential into real adoption and earning institutional trust to compete with XRP Ledger and Stellar”coindcx.com. In other words, Pi can only measure up if it can demonstrate real-world usage and credibility at the scale of global finance.

Future Outlook

What might the future hold for Pi relative to XRP and Stellar? Analysts outline scenarios. In a best-case scenario, Pi could indeed become a major ISO 20022-aligned payment network. Its timing (building compliance from the start) means Pi can avoid retrofits that legacy chains faceccn.com. By 2025, banks will be ready for ISO 20022; if Pi is also ready, it could secure a first-mover advantage among new entrantsccn.comccn.com. A strong on-ramps and partnerships could boost Pi’s transaction volumes and liquidity to rival smaller corridors of Ripple and Stellar.

In a moderate scenario, Pi might excel in limited domains (for example, Pi remittances in certain countries) but fail to attract major banks. It could find a niche in emerging markets where its mobile app is popular, similar to how Stellar has focused on particular corridors.

In a worst case, Pi’s upgrade under-delivers. Technical, regulatory, or adoption issues could keep it from scaling. If token liquidity remains low or compliance gaps persist, Pi might remain mostly a community or speculative project, never fully integrating with traditional financecoindcx.comccn.com.

The coming year will be telling. As SWIFT transitions and banks test new rails, Pi’s progress – such as developing its DEX, completing ISO certification, and launching partnerships – should become clearer. Observers will watch metrics like on-chain transaction volumes, liquidity growth, institutional engagements, and whether mainstream exchanges list PI. For now, Pi’s claim of ISO 20022 compliance is a positive signal but still needs validation. Investors and users should follow developments closely, keeping in mind that real impact depends on execution.

Disclaimer

Disclaimer: The information in this article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Cryptocurrency investments are highly volatile and speculative. We encourage you to perform your own due diligence before making any decisions, and consider consulting a licensed financial advisor. Any references to projects or developments are based on publicly available information and may change over time. All actions you take based on this information are at your own risk.

Author

Written and reviewed by Ali Hamza. Do your own research and proceed at your own risk.