Introduction

Bitcoin’s jump to approximately $111,000 early in November seemed like a bullish signal — a late-week rally capping what many hoped might be the start of a sustained move higher. However, the relief was short-lived. A major pipeline of selling pressure from whale wallets, combined with sceptical trader behaviour, has re-lit fears of a protracted bear market and left many market participants asking whether the rally has legs or if it’s simply a trap. The following examination will explore the current price action, on-chain signals, whale behaviour, macro factors, and why the probability of a deeper corrective phase remains elevated.

The rally to $111K — what triggered it?

On Sunday, Bitcoin briefly touched a local high of roughly $111,129. TradingView That level represented the highest point for November to date, but the context of the move matters. Analysts noted a last-minute weekend bid into the weekly close, with reported buying activity on major platforms like Binance and Coinbase. TradingView

Yet despite the jump, important resistance lines remained unclaimed, such as the 21-week exponential moving average at about $111,230. TradingView

In short: the rally was modest, late-week, and lacked convincing follow-through into weekday sessions — a classic setup where bear market traps often form.

Why traders remain cautious

Whale selling activity

One of the most immediate concerns is a large wallet (or wallets) suspected of distributing hundreds of millions of dollars worth of Bitcoin. Reports suggest that one whale has sold over $650 million since the October crash. TradingView

Moreover, Exchange data reported renewed outflows to wallets identified with high-net-worth actors ahead of the recent rally. These supply moves undermine bullish conviction and raise red flags that this rally might be supply-driven rather than demand-driven.

Weak follow-through and liquidity concerns

A true breakout requires sustained volume, consistent buying across multiple sessions, and broad participation. Instead, what occurred was a late-week spike followed by selling pressure entering the weekly close — a pattern consistent with distribution rather than accumulation. As one trader put it: “Another Sunday pump, and we know how this ends.” TradingView

The spectre of a bear market

Taken together, the weak breakout, large-wallet outflows, and absence of sustained demand form the backdrop of renewed bear market fears. Bitcoin is not just stalling; some market participants believe the structure may already be shifting to one of higher risk and lower probability of a straight-line move higher.

Technical structure and key levels

Resistance levels

- ~$111,230: 21-week EMA – still unclaimed. TradingView

- ~$112,000+: cited by trader “TedPillows” as the level Bitcoin must reclaim to reduce risk. TradingView

Support levels

- ~$100,000 zone: Historically important and referenced in multiple analyses. TradingView

- A break below that could open a path toward $90K or lower — a scenario many associate with bear market conditions.

Chart patterns

Bitcoin is forming lower highs (failed reclaim of prior peaks) and showing a lack of conviction on the bounce — hallmarks of a market that might be caught in a bear-market trap more than a new bull phase.

Macro and broader risk context

The crypto market does not exist in isolation. Current macro signals include:

- Rising regulatory scrutiny and institutional caution.

- Large-scale liquidations and changing liquidity regimes.

- Broader risk-off sentiment creeping into equities and risk assets.

When these external pressures align with internal weaknesses (weak breakout, whale selling), the risk of a deeper bear market increases significantly.

What would confirm a bear market vs. what would invalidate it

Bear-market confirming signs:

- Bitcoin closes below $100K with strong volume and no immediate reclaim.

- Large-wallet outflows continue without offsetting accumulation.

- Macro signals worsen (risk-off flows, regulatory shocks, institutional exits).

Bear-market invalidating signs:

- Sustained breakout above $112K with increased volume and broad participation.

- Evidence of heavy accumulation in large wallets and on-chain transfer to cold storage.

- Macro liquidity improves, risk sentiment turns back on, and crypto flows accelerate.

Until one of these clear signals emerges, the probability leans toward the bear-market scenario.

Trading and risk-management implications

Given the current setup, traders and investors should proceed with caution:

- Use defined risk: keep position sizes conservative until breakout conviction increases.

- Monitor on-chain whale transfers to gauge supply movements.

- Watch for false breakouts: late-week rallies followed by weekday weakness may signal traps.

- Consider hedges or partial profit-taking if holding large exposure into resistance zones.

- Avoid the “buy the pop” mentality without proof of follow-through — especially if you believe a bear market structure is possible.

Pathways ahead — scenario planning

Bull regained:

Bitcoin reclaims $112K+, volume accelerates, whale selling abates, and the market moves toward $130K+. This path invalidates the bear-market thesis and returns the market to a bullish phase.

Range bound:

Bitcoin remains stuck between $100K–$112K for weeks, volume stays low, and traders wait. In this scenario, the bear market risk remains latent but not yet triggered — a period of consolidation and hesitation.

Bear phase triggered:

Bitcoin drops below $100K with strong volume, whale outflows accelerate, macro risk increases, and the narrative shifts openly toward a bear market. Prices may test $90K or lower, and the prevailing structure would likely shift toward slower growth and higher volatility.

Why this moment matters

From a structural viewpoint, this is a key moment for Bitcoin. The difference between entering a new bull phase and slipping into a bear market lies in the strength of the breakout and the commitment of long-term capital. The recent rally to $111K lacked that commitment. For many, that raises the stakes: manage risk now or face larger drawdowns later.

The human element — sentiment and psychology

The message among many traders is one of scepticism. The phrase “Sunday pump” surfaced repeatedly, referring to late-week rallies that don’t carry through. TradingView Market psychology is fragile: when large holders sell, smaller participants tend to hesitate or exit entirely, which compounds risk. A genuine bear market is as much about flow and sentiment as it is about price.

Historical analogs — lessons from previous cycles

During the 2018 and 2022 bear markets, Bitcoin’s mid-cycle rallies also saw sharp 20–30% gains followed by deeper retracements. The $111K level today mirrors those “false breakouts” — periods where optimism briefly returned before renewed declines.

Analysts note that such traps often occur at the midpoint of the bear market, fooling traders into believing the bottom is behind them.

Key scenarios ahead

The consolidation phase

Bitcoin stabilizes between $100K and $112K. Market volatility shrinks while liquidity rebuilds, forming a base for the next cycle.

The breakdown

If Bitcoin closes below $100K with strong volume, the structure confirms another bear market leg. Prices could slide to the $85K–$90K range.

The surprise breakout

A sustained close above $112K invalidates the bear market thesis and may trigger a momentum push to $125K or higher.

Sentiment data — greed fades, fear returns

The Bitcoin Fear & Greed Index dropped from 68 (“Greed”) to 44 (“Neutral”) within three days of the rally. Social media activity mirrored this decline, with sentiment analysis from LunarCrush showing a 35% drop in bullish mentions.

When optimism fades quickly after a short-term pump, it often precedes continued downside in a bear market environment.

Miner activity and profitability pressure

Miners are another crucial indicator. Mining difficulty reached a record high in late October, but profitability has been slipping since. Hashrate remains stable, but several mid-sized mining firms reported liquidating reserves to cover operational costs.

Historically, miner capitulation often marks the midpoint — not the bottom — of a bear market cycle. If hashprice continues to decline, it could exacerbate selling pressure.

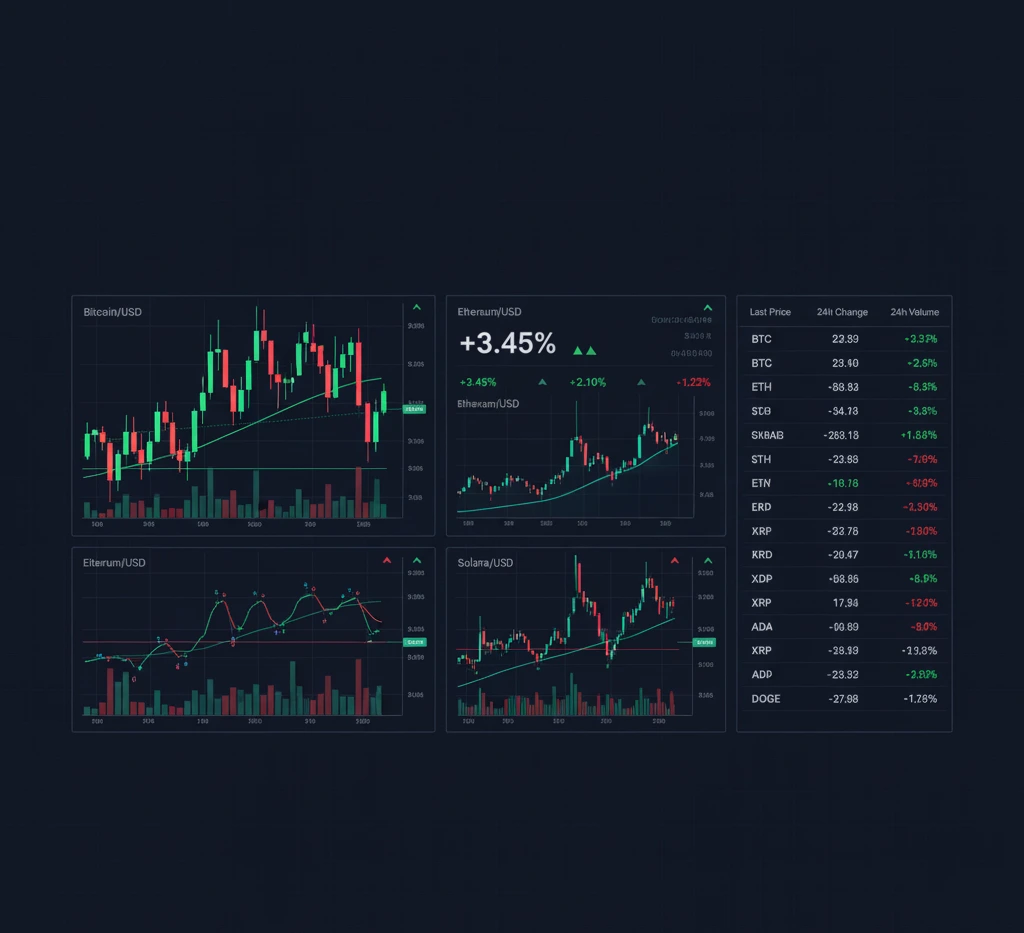

Altcoin correlation and market breadth

Altcoins, especially Ethereum, Solana, and BNB, have mirrored Bitcoin’s volatility. When Bitcoin dominance rises during pullbacks, it’s often a defensive rotation — capital fleeing smaller assets.

This behavior tends to reinforce bear market psychology, as investors prioritize safety over speculation. Until altcoins outperform Bitcoin on strong volume, the market remains fragile.

Whale accumulation zones — opportunity or trap?

Some data shows selective whale buying near $100K, but analysts warn this could be short-term arbitrage. The difference between strategic accumulation and short-covering defines whether this zone is a trap or the start of the next cycle.

In past bear market phases, accumulation often continued for 2–3 months before prices stabilized. Thus, early buyers may still face volatility.

Psychological fatigue among traders

After months of sideways movement, traders show fatigue. Volatility compression creates boredom and overtrading, two ingredients that lead to unnecessary losses.

Bear markets test patience more than skill — the ability to “do nothing” often determines survival. Recognizing emotional traps during bear market conditions is crucial for long-term success.

Long-term outlook — the bigger picture

Despite near-term pessimism, long-term fundamentals remain robust. Network adoption continues, institutional frameworks mature, and regulatory clarity is improving globally.

Even in prior bear markets, Bitcoin eventually recovered stronger — building resilience with each cycle. The challenge now is enduring the noise and waiting for data that confirms a real macro and on-chain turnaround.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk, including the possibility of total loss. Always carry out your own research and consult a licensed financial advisor before making investment decisions. Do at your own risk.

Conclusion

Bitcoin’s climb to $111K in early November captured attention — but the fundamental setup behind the move leaves much to be desired. The absence of strong follow-through, the resurgence of whale selling, and weak overall demand create meaningful risk of a shift into a genuine bear market. While a turnaround remains possible, until clear signs of broad-based buying emerge, the weight of probabilities favours caution. For traders and investors alike, the moment is one of high stakes: either prepare for further volatility or wait for evidence of a real breakout. The market may be on knife-edge between continued accumulation and a structural bear phase.

Author Review

Author: Ali hamza