why Bitcoin slips is the story right now

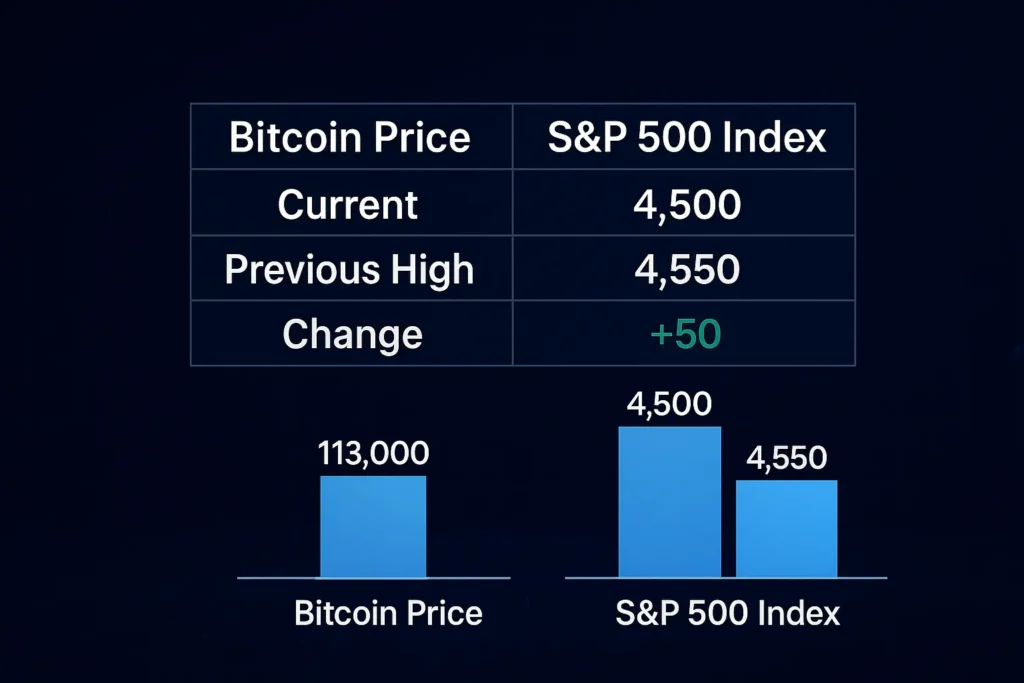

Bitcoin slips below its recent highs, trading around $113,000 even as U.S. stocks pushed the S&P 500 to new record closes ahead of a Federal Reserve rate decision. That gap between stock strength and crypto weakness is important: it tells us that capital flows, positioning and short-term risk dynamics are diverging across asset classes — and that Bitcoin slips is not just a price blip but a potential signal for a reallocation or a volatility regime change. TradingView

Quick market snapshot — what happened

- The S&P 500 hit a fresh all-time high on optimism about future rate moves and strong corporate results. Equities rallied into the Fed event, lifting sector leadership in technology and cyclical names. Nasdaq

- At the same time, Bitcoin slips from local peaks near $116,000 back toward $113,000 after a recent sell-off and a retest of gap and resistance areas. Trading desks noted thin liquidity and derivatives positioning as drivers of the move. TradingView

Why this matters: when an equity benchmark like the S&P 500 is making record highs while Bitcoin weakens, that suggests either (a) investors prioritizing equities into a risk-on Fed environment, or (b) cross-asset rotation and profit-taking removing tailwind from crypto in the very short term. Both outcomes affect how you interpret Bitcoin slips.

Technical picture — levels and structure that matter

Traders and algo desks watch a handful of levels that currently inform the Bitcoin slips thesis:

- Immediate support: $110K–$112K. A daily close below these levels reinforces the short-term weakness.

- Key pivot: $107K (a lower support that often acts as a liquidity floor).

- Resistance: $116K–$118K — the area where Bitcoin repeatedly failed in recent sessions.

Momentum indicators (RSI, MACD) on daily and 4-hour charts have softened; while not deeply oversold, they indicate that momentum favors a rotation lower unless volume and open interest turn decisively positive. In short, the technicals explain why Bitcoin slips can accelerate if supportive metrics deteriorate.

Why Bitcoin diverged from equities

There are three practical reasons why Bitcoin slips while the S&P 500 rallies:

- Positioning differences: Institutional money (ETFs, mutual funds) often flows into equities more directly than into crypto. When a Fed move is priced as easing, equities may react first while crypto waits for confirmation. Reuters

- Derivatives microstructure: Bitcoin markets have large futures and options concentrations; clustered liquidations or gap fills can trigger sharp intra-day moves independent of macro news. These technical flows often cause Bitcoin slips that look idiosyncratic versus stocks. TradingView

- Safe-haven reallocation nuance: Some investors treated recent Bitcoin strength as a speculative leg and locked profits into equities or cash, which can produce a temporary divergence. If flows reverse, Bitcoin slips could rapidly retrace.

On-chain & derivatives signals behind the move

To understand Bitcoin slips, follow these metrics:

- Exchange balances: Falling exchange balances historically support price; stable or rising balances can coincide with sell pressure. Recent snapshots showed mixed exchange flows — some net outflows but also active selling from margin desks. AInvest

- Funding rates & open interest: Flat or negative funding with rising open interest suggests short building; a rapid flip to positive funding signals long crowding and potential squeezes. During the period when Bitcoin slips, funding was tepid and OI showed no explosive long conviction. Trading News

- CME gaps & futures flows: Weekend CME gaps can act as magnets and microstructure hazards — trading around them often explains why Bitcoin slips even when macro appears supportive. TradingView

Macro context — the Fed, yields and cross-asset linkages

The timing of the S&P 500’s record highs and the Fed rate move matters for the Bitcoin slips story:

- If the Fed signals a path toward cuts (or the market expects easier policy later), equities typically rally as discounted future earnings rise — the S&P can soar while speculative assets like Bitcoin initially lag as flows rotate. AP News

- Conversely, if the Fed emphasizes caution or hikes further, correlated risk assets can fall together. The key is how the Fed’s tone filters through bond yields, dollar strength and liquidity — all inputs that decide whether Bitcoin slips become a deeper correction or a shallow pullback.

Scenarios — how the Bitcoin slips episode plays out

Below are three plausible scenarios and what each means for traders:

Scenario A — Shallow retrace & quick recovery (base case)

If Bitcoin holds $110K and funding stabilizes, Bitcoin slips is a temporary pullback. Re-entry by institutional buyers and fading of short sellers could drive a retest of $116K–$120K within weeks.

Scenario B — Rangebound consolidation (neutral case)

If Bitcoin trades between $105K and $118K for several weeks, Bitcoin slips would be a longer consolidation. This environment favors option strategies or range trading while waiting for clearer macro direction.

Scenario C — Deeper correction (risk case)

A decisive daily close below $105K could accelerate Bitcoin slips to the $95K–$100K zone as stop liquidity and retail capitulation combine with macro risk aversion. Traders should reduce leverage in this scenario.

Trade ideas and practical positioning

These are not recommendations — they are structured ways traders might act given the Bitcoin slips setup.

Conservative investors

- Add in tranches, using dollar-cost averaging between $110K and $100K. Protect large positions with long-dated puts as insurance.

Active swing traders

- Trade the range: buy near support ($110K) and trim into resistance ($116K–$118K). Use tight stops below $108K.

Options & hedgers

- If you fear deeper legdown, buy protective put spreads. If bullish on a rebound, call spreads can limit premium cost while participating.

Liquidity traders

- Watch CME gap fills and liquidation maps closely; short-term shorts into gap tails can work but be fast to exit if squeezes occur.

Why the Bitcoin slips narrative can change fast

Crypto markets are hypersensitive to a handful of catalysts that can flip the Bitcoin slips narrative quickly:

- ETF / institutional flow headlines (inflows can arrest weakness).

- Unexpected Fed language (hawkish = tougher for risk assets; dovish = supportive). Reuters

- Large on-chain transfers (sudden movement from cold to exchange wallets can increase near-term selling).

- Macro shock (a bond selloff or geopolitical risk can reduce risk appetite and prolong Bitcoin slips).

Because these triggers can materialize quickly, monitoring real-time feeds matters more than static analysis.

Cross-asset watchlist — what to monitor alongside BTC

When Bitcoin slips, keep an eye on:

- S&P 500 breadth & tech leadership: Strong breadth supports risk appetite; narrow leadership suggests fragility. Nasdaq

- Gold and dollar: Sudden moves in safe havens often foreshadow rotations that affect crypto.

- US 2-10 year yields: Rising long yields can pressure risk assets and catalyze Bitcoin slips expansions.

- Crypto derivatives (funding, OI): Shifts here inform potential squeezes. Trading News

Sentiment & behavioral indicators

Market psychology helps explain why Bitcoin slips matter beyond the chart:

- Fear & Greed index readings can shift quickly; a move toward “fear” often corresponds to sharper drawdowns.

- Social chatter & on-chain whale alerts: spikes in sell-pressure mentions or large transfers often precede or coincide with Bitcoin slips.

- Search trends: surges in “sell Bitcoin” or “BTC price drop” correlate with higher volatility windows and retail capitulation.

Longer-term perspective: why intermittent Bitcoin slips don’t negate the bull case

Even if Bitcoin slips in the short term, several structural arguments support a longer-term bullish case:

- Institutional adoption: custody, ETFs and corporate treasuries continue to expand access and demand for Bitcoin. Bitcoin Magazine

- Network fundamentals: hash rate and active addresses remain resilient, suggesting long-term utility and security.

- Macro diversification demand: over time, some allocators view Bitcoin as a portfolio diversifier — episodic Bitcoin slips create accumulation opportunities rather than trend reversal.

Quick checklist for active traders during Bitcoin slips

- Monitor daily close vs. $110K and $107K.

- Watch funding rates: sustained positive funding supports rallies; negative funding with rising OI warns of short builds. Trading News

- Track CME gap map and liquidation clusters. TradingView

- Keep position size modest into major macro events (Fed, CPI, payrolls).

- Use protective hedges if exposure is material.

Conclusion — a measured read on Bitcoin slips

Bitcoin slips from its intra-week highs to ~$113K is a meaningful short-term occurrence, but its ultimate significance depends on how macro flows, derivatives positioning, and institutional demand evolve over the next days and weeks. If Bitcoin reclaims $116K with healthy volume, the slip will likely be seen as a shallow correction. If instead liquidity dries and the market closes decisively below $107K, Bitcoin slips could signal a deeper drawdown requiring more cautious positioning. For now, treat this episode as a scenario to manage — not a final verdict.

Disclaimer

This post is for educational and informational purposes only and does not constitute financial, tax, or investment advice. Trading digital assets carries significant risk and you might lose some or all of your capital. Always perform your own research (DYOR) and consult a licensed advisor before making investment decisions. Do at your own risk.

Author Review

Do at your own risk.

Author: Ali Hamza