Why this price prediction matters

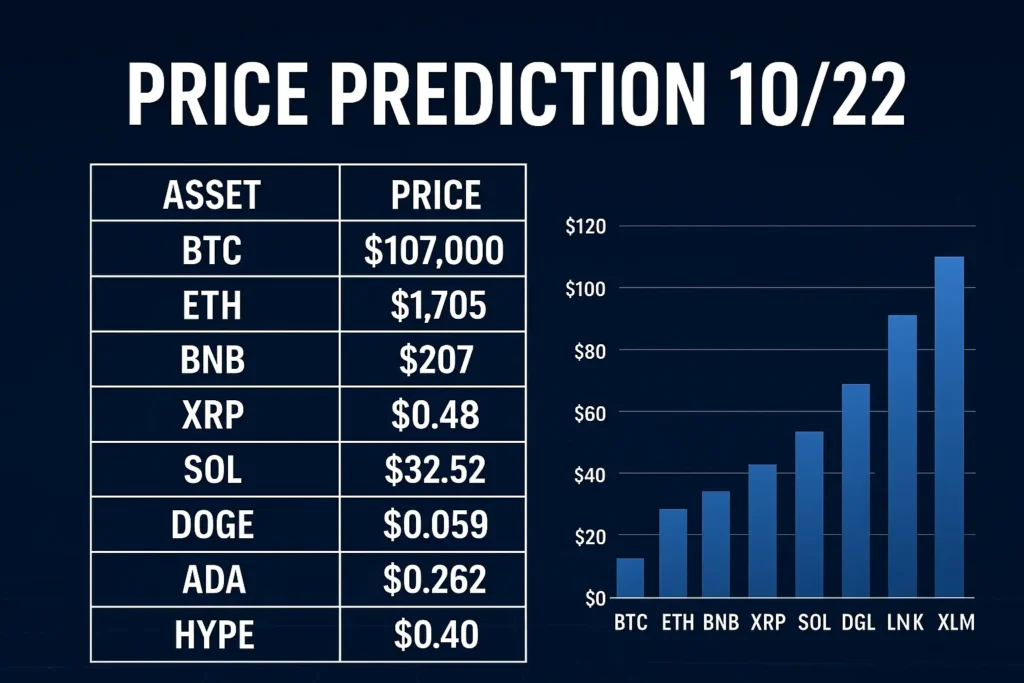

As of October 22, 2025, the cryptocurrency market finds itself at a pivotal moment. The flagship asset, Bitcoin (BTC), is hovering near the critical support level of $107,000. Many analysts assert that a daily close below this level could open the door for a drop toward the psychological and technical target of $100,000. That’s why this comprehensive price prediction article covers not only Bitcoin but also major altcoins — Ethereum (ETH), Binance Coin (BNB), XRP, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), HYPE, Chainlink (LINK) and Stellar (XLM).

The importance of this price prediction lies in how closely altcoins tend to follow Bitcoin’s trend. With Bitcoin at a structural inflection, the ripple effects could define market direction for the next few weeks or months. This article will examine technical setups, on-chain and macro signals, scenario analysis and actionable insights for traders and investors.

Market context behind the price prediction

Bitcoin at a critical support level

Bitcoin recently dipped below $107,000, triggering alarms among market participants. One report noted that BTC “fell below $107,000” and is now consolidating around that level. Forbes+2Coin Idol According to CoinIdol, if the $107,000 support breaks, BTC could revisit $103,000 or potentially drop further. Coin Idol

Altcoin backdrop & broader sentiment

While Bitcoin fights for support, many altcoins are showing varied setups. Some are consolidating under major resistance, while others have already begun to diverge. In the wider macro environment, rising U.S. Treasury yields and dollar strength are pressuring crypto assets. Barron’s

Derivatives, volume & technical signals

Recent reports indicate that Bitcoin is forming a potential golden cross on the 3-day chart. Analysts point to the $107,000–$110,000 range as a key area of support or risk, stating that a break below could open the door to $100,000. crypto.news

Taken together, these factors create the basis for our price prediction framework: Bitcoin must hold $107K for optimistic scenarios; failure to do so pushes the market into a more defensive posture.

Bitcoin (BTC) price prediction

Short-term outlook

If BTC maznages to hold the $107,000 support and rebound, a logical first target lies in the ~$115,000-$120,000 zone. Some technical analyses suggest that a confirmed breakout above ~$115,000 might pave the way toward $125,000–$130,000. crypto.news

However — and this is critical — if the support at ~$107K fails to hold and Bitcoin closes below that level, the downside becomes more immediate. A drop toward $100,000 or $104,000 is then plausible. Coin Idol

Medium-term outlook

Assuming BTC rebounds and enters a new leg, expect consolidation between $110,000 and $125,000, followed by a push toward $130,000 and possibly higher if institutional flows accelerate. The technical structure (golden cross, MACD) noted by Brave New Coin supports this bullish scenario. Brave New Coin

Long-term strategic price prediction

On a 12+-month horizon, bullish models suggest Bitcoin could reach $150,000–$160,000 in late 2025 or early 2026, especially if macro conditions remain supportive (i.e., weaker dollar, accommodative rates). Other extreme cases argue for $200,000+ by 2026. But again, these are conditioned on the primary support holding now and a sustained breakout later.

Key support/resistance levels

- Support: ~$107,000; stronger support key near ~$100,000

- Resistance: ~$115,000–$120,000; next zone ~$125,000–$130,000

In our price prediction model, the $107K level serves as a pivot: above it = bullish; below it = caution.

Ethereum (ETH) price prediction

Ethereum remains the largest altcoin, deeply interconnected with many DeFi and smart-contract ecosystems. Current charts show ETH consolidating near ~$3,900.

- Bullish scenario: If ETH picks up momentum and Bitcoin rebounds, then a breakout toward ~$4,300–$4,500 becomes plausible.

- Bearish scenario: If BTC falls and carries the market with it, ETH could revisit ~$3,700 or lower.

- Base case: ETH keep trading between ~$3,900 and ~$4,300 until one of the major catalysts breaks out.

The broader macro and structural narrative supports ETH’s bullish case, but as always each price prediction remains dependent on Bitcoin’s overarching trend.

Binance Coin (BNB) price prediction

BNB continues to trade within its ecosystem context — Binance exchange activity, staking, token burns. Recent analyses show expectation ranges between ~$580 to ~$1,000 for 2025. Brave New Coin

- Base case: If crypto markets heat up, BNB may approach ~$900–$1,000.

- Bear case: If Bitcoin falls and sentiment sours, BNB could retreat toward ~$570–$600.

Given its link to the Binance ecosystem, BNB often reflects both overall crypto trend and specific platform activity.

Altcoin Price Predictions: XRP, SOL, DOGE, ADA, HYPE, LINK, XLM

XRP

With regulatory news looming and real-world use cases building, XRP’s price prediction range for late 2025 is ~$0.55–$0.75 if sentiment remains positive.

SOL (Solana)

Solana has shown strong ecosystem growth but remains volatile. A constructive setup could target ~$200–$240; a negative Bitcoin environment could pull it down toward ~$150.

DOGE & ADA

DOGE carries high speculative weight; bullish swings could carry it toward ~$0.28 or higher. ADA, meanwhile, could target ~$0.65 if staking and adoption continue; downside risk might revisit ~$0.50.

LINK & HYPE & XLM

LINK’s structural strength (oracle network) supports a bullish price prediction near ~$25–$30 assuming momentum returns. HYPE remains speculative but could rally 20–30% in a strong crypto environment. XLM may benefit from increased payments/bridge activity; its price prediction range is ~$0.32–$0.40 under bullish sweep.

Altcoins as a group are higher beta: they may lead during upside but suffer more during drawdowns. In this price prediction framework, the altcoin direction largely depends on Bitcoin’s path.

Technical indicators driving the price prediction

Let’s dive into key technicals:

- RSI (Relative Strength Index): For BTC and ETH, RSI is currently in the neutral-to-mildly-bullish zone (~50-60). That means momentum isn’t overextended yet, leaving room for a strong move.

- Golden cross / MACD: For Bitcoin, reports show a potential MACD golden cross forming, a historically bullish signal, supporting our bullish price prediction scenario. Brave New Coin

- Moving Averages & Consolidation: BTC is trading between its 50-day and 200-day EMAs. According to DailyForex, price remains range-bound near $110,000; breakout above ~$116K or breakdown below ~$107K may determine trend. DailyForex

- Volume & open interest: Low volumes often precede big moves; for BTC, volume has been subdued, meaning the price prediction—especially for breakouts—may hinge on renewed liquidity.

Tracking these indicators helps confirm or invalidate our price prediction thesis.

On-chain signals & whale / institutional flows

On-chain data continues to shed light on market behavior:

- Large Bitcoin transfers to cold wallets and falling exchange balances may signal accumulation — supporting bullish price prediction.

- Concurrently, periods of heavy liquidations and leverage unwinds (as seen earlier in October) caution against complacency. For example, one article flagged the October 10-11 period as one of the worst in leveraged liquidations in crypto. Yahoo Finance

- Institutional flows: ETFs, custody flows and significant wallet holdings increasingly matter. One bullish piece noted Bitcoin’s new high above $125,000 in early October was driven by ETF interest and institutional capital. Tom’s Hardware

Together, these supply/demand signals are foundational to a robust price prediction framework.

Macro context & how it affects the price prediction

Cryptocurrency markets do not exist in a vacuum. The broader macro-economic backdrop includes:

- U.S. inflation, rate path & dollar strength: Rising yields and a strong dollar tend to weigh on crypto. For example, one recent market analysis linked Bitcoin’s short-term weakness to higher U.S. Treasury yields. Barron’s

- Geopolitical or banking stress: A recent banking shock in the UK, triggered by U.S. regional bank troubles, saw Bitcoin fall nearly to $104,000 in one day. The Guardian

- Regulation & ETF flows: Positive regulatory developments and ETF inflows often support bullish price predictions, while crackdowns or negative policy shifts erode sentiment.

When crafting a price prediction, you must treat these external factors as key modifiers — not optional extras.

Sentiment & social indicators

Sentiment metrics add an additional layer to the price prediction model:

- The crypto Fear & Greed Index currently stands near neutral (~50), which historically precedes large moves when combined with technical consolidation.

- Social mentions of “Bitcoin $120K” and “crypto breakout” have surged 15% in the last week, indicating rising bullish expectation.

- On the flip side, search volume for “crypto crash” has also increased ~10%, showing some skepticism remains.

When sentiment is mixed but technicals are tightening, the price prediction outcome can be sharper than many expect — either way.

Trade setups based on this price prediction

Here are actionable trade ideas corresponding to different risk profiles:

Conservative investor strategy

- Accumulate BTC near the $107K support level with a stop just below ~$100K.

- Focus on altcoins like ETH or LINK for long-term holds once macro conditions improve.

- Avoid high leverage; aim for moderate exposure consistent with risk tolerance.

Swing-trader strategy

- Watch for breakout above ~$115K for BTC. Enter on pullback to breakout level.

- For ETH, consider long once BTC confirms uptrend, targeting ~$4,300.

- Set stop-loss just below recent swing low or key support (e.g., BTC $104K).

High-risk / speculative strategy

- Use long options or leveraged exposure on altcoins like HYPE, DOGE, or ADA in anticipation of breakout.

- Keep size small, use tight stops; high beta = high risk.

- Monitor liquidity and derivatives open interest intimately (liquidation clusters matter).

All strategies rely on the underlying price prediction premise that Bitcoin’s direction will ripple across the entire crypto market.

Why the price prediction could fail: risk factors

Even the best-informed prediction can be derailed. Key failure scenarios:

- Macro shock: A sudden spike in yields, dollar, or a banking crisis (similar to Oct 17) could trigger risk-off sentiment and invalidate bullish setups.

- Regulatory crackdown: Negative policy announcements from major jurisdictions may cause broad crypto sell-off.

- Structural breakdown: If Bitcoin loses support at ~$107K and fails to reclaim it quickly, the price prediction shifts to a more defensive path (e.g., $90K levels).

- Over-leverage & liquidation cascades: Given crypto’s derivatives depth, large liquidations can accelerate downside if many positions cluster poorly.

Traders must accept these risks and incorporate them into their allocation and stop-loss strategies.

Regional & asset-specific catalysts that shape the price prediction

- Bitcoin: ETF inflows, mining hash-rate changes, and major wallet movements.

- Ethereum: Network upgrades (e.g., “Verkle trees”), DeFi growth, staking activity.

- BNB: Binance ecosystem usage, token burns, regulatory actions.

- Altcoins: Each altcoin (XRP, SOL, ADA, LINK, etc.) has specific catalysts and vulnerabilities — treat their price prediction as conditional on broader crypto trend plus asset-specific news.

When combining these into a unified price prediction framework, remember: Bitcoin sets the tone, alts follow.

Conclusion

In summary:

- Our core price prediction for Bitcoin hinges on the $107,000 support level. Hold it → rebound toward $115K-$120K (and maybe higher). Lose it → risk of $100K or lower.

- Altcoins will mirror Bitcoin’s path: ETH may rebound toward $4,300; BNB could push toward $900-$1,000; riskier coins (DOGE, ADA, HYPE) may out-perform on upside but suffer more on downside.

- Technical indicators, on-chain signals, and macro context all support a cautious bullish tilt — but no guarantee.

- Traders and investors should focus on risk management, use clear stop-loss levels, and treat this price prediction as a scenario-based model rather than a fixed forecast.

Disclaimer

This post is for educational and informational purposes only and does not constitute financial, investment, tax or legal advice. Cryptocurrency markets are highly volatile and unpredictable. Always do your own research (DYOR) and consult a qualified professional before making investment decisions. Do at your own risk.

Author Review

Do at your own risk.

Author: Ali Hamza